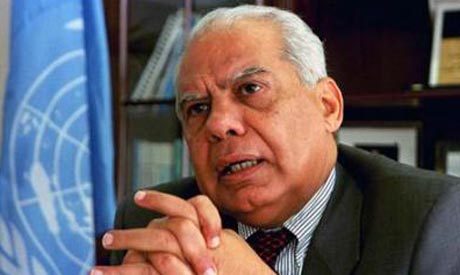

Hazem El-Bablawi, Egypt's recent appointed finance minister (Photo: Reuters)

Egypt’s minister of finance does not expect the downgraded rating of US debts to affect the Egyptian economy, saying the country is "not integrated into the world economy".

The international economy will see a "new phase with a smaller role of the dollar", Hazem El-Beblawi said, but "this would take years."

China is the largest holder of dollar reserves, and "[it] works on protecting the dollar," he added, during a press conference held on Sunday.

Beblawi even sees a window of opportunity should the dollar slump, saying that as Egypt's foreign debts are in dollars a lower value for the US currency "is not exactly harmful for us".

The recently appointed minister also said Egypt’s foreign reserves are not only in dollars and the basket of international reserves is quiet varied. He refrained from giving more details.

"What happened in the USA is about a need for liquidity. I am afraid liquidity is an urgent matter in Egypt too, this is my first concern," said Beblawi, adding that the liquidity crunch might not be have top priority for reform "but it is the most urgent matter to address".

The minister revealed some parts of his plan to improve liquidity, beginning with imposing new controls on public spending. He has already asked ministries to present their visions for further budget trimming.

Relying on the banking sector to increase liquidity was also an option, he said, but stressed this had its limits.

Borrowing by issuing bills and bonds only masks the problem of a structural wide budget deficit, said Beblawi.

"There is an urgent need for rebalancing the budget. Despite the latest trimming, we still have a 8.9 per cent deficit."

The former minister of finance, Samir Radwan, modified the budget project as to reduce budget deficit to 8.9 per cent instead of 11 per cent.

Nevertheless, to meet the targeted deficit, new borrowing for the fiscal year 2011-2012 will cost the government some LE28 billion.

This sum might not be huge, said Beblawi, but looking at the long-term effect it creates a burden of deficits cumulated along the past years. "Interest payments will be as high as LE106 billion for the current year," he commented.

Beblawi excluded the possibility of imposing new taxes to raise money.

"I know that tax receipts in Egypt are low compared to industrialised countries [15 per cent versus 30 per cent in some cases]. Even in Morocco and Jordan tax revenues per GDP are higher than in Egypt. The problem is a tax reform will take at least a year for us to feel the effects."

If the liquidity crunch continues to bite, Beblawi said he would advise the Supreme Council of Armed Forces to allow foreign borrowing.

"Borrowing from international institutions can be good or bad, depending on what you need and on what are the terms are. There is no a priori stand whether for or against it,” he said.

"If we need a financial support, we'll go and get it from anywhere. Or at least that will be my advice to the SCAF."

Short link: