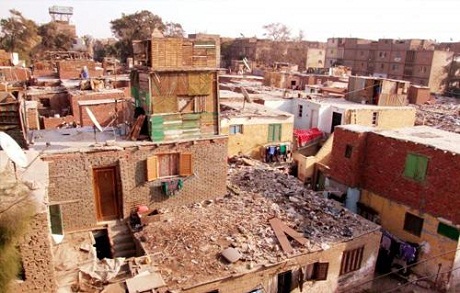

Millions of Egyptians live in slums which lack proper licensing and facilities across the country (Photo: Al Ahram)

The Central Bank of Egypt (CBE) has allowed mortgage companies for the first time to provide financing for those who seek to buy homes in order to both ease the loaning burden on existing lenders as well as expand the base of beneficiaries, it said in a statement Wednesday on its website.

Tarek Amer, the CBE’s governor, announced on Wednesday that the housing ministry signed loans worth EGP 10 billion ($1.3 billion) with the country’s banks to finance the construction of 450,000 units.

The CBE also added on Wednesday two new tiers of interest rates to accomodate more borrowers.

Low-income earners – those making less than EGP 1400 a month – will now be offered an interest rate of 5 per cent. Upper-middle income earners – those who make EGP 15,000 a month or for families with a monthly income of EGP 20,000 -- can borrow for homes at 10.5 per cent interest rate.

The existing two-pronged tier, in effect since 2014, allows banks to finance mortgages for low-to-medium income earners at interest rates of 7 and 8 per cent, respectively. In that year, the CBE allocated of EGP 10 billion to help banks provide loans to home seekers under those terms.

Short link: