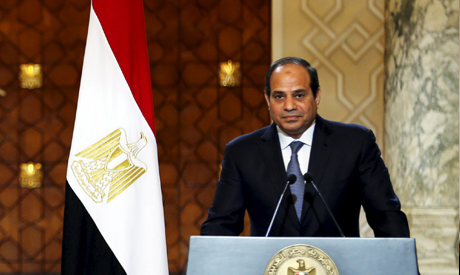

Egypt's President Abdel Fattah El-Sisi

Egypt's president Abdel-Fattah El-Sisi met on Monday with representatives from 27 regional and international investment funds in Cairo, in a meeting organised by Egypt's biggest investment fund, EFG-Hermes, to discuss new investment opportunities in the Egyptian market.

El-Sisi emphasised to the group that the economic reforms his government has undertaken in recent months reflect serious political will to fix the country's chronic economic problems, presidential spokesman Alaa Youssef said in a statement.

In early November, the Central Bank of Egypt (CBE) decided to float the pound against the dollar and raise key interest rates as part of a set of reforms aimed at alleviating the dollar shortage and eradicating the black market.

Egypt embarked on a fiscal reform programme in July 2014 to curb the growing state budget deficit – 12.2 percent of then-GDP – by cutting subsidies and introducing new taxes including the value added tax.

Youssef said the President made sure to meet with representatives of regional and global investment funds to stress the government's efforts to overcome obstacles and provide an attractive climate for investment.

"Egypt enjoys a large number of investment assets and promising opportunities in various sectors. [The country] is also witnessing political stability despite troubled conditions in the region," El-Sisi said.

On the government's national projects, El-Sisi said he "looks forward to the investments that will contribute to Egypt's economic development efforts, taking into account that Egypt has one of the highest rates of return on investment in the world."

The meeting was attended by Egypt's prime minister, the CBE governor, and the ministers of oil, international cooperation, finance, investment and industry.

The ministers presented their ministries' current efforts to encourage investment and stimulate the economy on legislative, administrative and procedural levels.

They highlighted the investment opportunities inherent in the cabinet's plan to issue Eurobonds in the upcoming period.

In late November, Egypt's finance minister Amr El-Garhy said that Egypt will issue $2.5 to 3 billion-denominated Eurobonds in the global bond market in the first half of January, which could produce a yield of 6 to 6.5 percent.

El-Garhy has said previously that bond sales could reach a denomination of $5 billion, depending on the investors' appetite for purchase.

In August, the finance ministry selected four international investment banks— the French Natixis, Citibank, JP Morgan and BNP Paribas—to issue the dollar-denominated Eurobonds.

Youssef said that all the representative's inquiries on the future of investment in Egypt and the government's reforms were answered.

Egypt's economy has been struggling since the 2011 uprising, with a sharp drop in tourism and foreign investment, two main sources of hard currency for the import-dependent country.

Short link: