Egypt’s international reserves reached unprecedented levels in December 2017 at $37.019 billion, an amount surpassing the pre-revolution figure of $36 billion.

While the government is targeting maintaining the foreign reserves at around $36 billion in 2018, it is also set to pay off more than $12 billion of debts this year, state news agency MENA reported earlier this month, citing a source in the Central Bank of Egypt (CBE).

This month alone, the CBE is set to pay $700 million to the Paris Club of debtors as part of its total debt to the club which currently amounts to $3.7 billion.

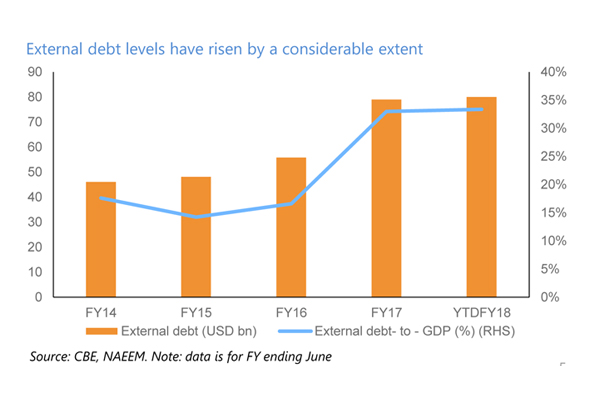

The repayment is part of the bi-annual installments owed to the club, usually paid in January and July. The Paris Club is an informal group of creditors whose role is to find coordinated solutions to payment difficulties experienced by debtor countries. Egypt’s foreign debt stood at $79 billion at the end of fiscal year 2016/2017, up 42 per cent from 2015/16.

The country’s aim to maintain the current level of reserves throughout 2018 at a time when it needs to pay some $12 billion in foreign debts raises questions about how it intends to cover the repayments.

Mahmoud Al-Masry, an economist at local investment bank Pharos Holding, said that Egypt would repay its debts through more foreign borrowing. He said that the forthcoming $4 billion Eurobond issue that will take place this month will not be added to the reserves, but will be used to repay debts.

“What the government will do is that it will borrow fresh funds and use them to repay old debts in what we could call a recycling process,” Al-Masry told Al-Ahram Weekly.

He explained that should other international credit-ratings agencies follow Standard and Poor’s (S&P) decision to revise Egypt’s outlook to positive, external borrowing would become cheaper and would lower interest rates.

In November 2017, S&P revised Egypt’s outlook to positive on rising reserves and a strengthening economic growth, but it maintained a B- sovereign credit-rating, reflecting wide fiscal and external deficits.

Photo: Central Bank of Egypt (CBE)

Meanwhile, international credit-ratings agency Moody’s in September opted neither to upgrade Egypt’s junk credit-rating nor improve its outlook from “stable”, citing the country’s increased external exposure and weak finances.

Al-Masry said the government was leaning towards external borrowing because this was cheaper than domestic borrowing, currently costing 15 per cent in interest rates. Egypt has been heavily borrowing from abroad to finance its budget deficit and cover its dollar shortage after years of political instability following the 25 January Revolution negatively affected investment inflows and tourism revenues.

Egypt has an annual financing gap, the difference between its dollar-denominated revenues and expenses, of around $10 billion. Its fiscal deficit stood at 10.9 per cent of GDP at the end of June 2017.

In addition to reaching financing deals with multinational lenders like the International Monetary Fund (IMF), World Bank, and African Development Bank, the country has resorted to the international debt markets.

Egypt issued $7 billion in Eurobonds in January and May 2017 on the global bond markets, both of which were oversubscribed, according to the ministry of finance.

Al-Masry said the “recycling” process would continue until a way was found to create fixed sources of finance to pay off the debt, either through manufacturing and exports or by improving the country’s services sector, including the Suez Canal and tourism.

“By doing so, Egypt’s recycling process will decelerate,” Al-Masry said, adding that it would be better to focus more on manufacturing and exports because services were more prone to external shocks.

On the level of the foreign debt, Al-Masry said it was not worrisome as long as Egypt was capable of repaying it. With its reserves of $37 billion, the CBE was in a strong position regarding foreign debt, he added.

Egypt was heading in the right direction in terms of trimming its budget deficit, reducing imports, and achieving fiscal consolidation, he said. “Any fear should not stem from the level of debt, but from the inability to repay it,” Al-Masry said.

Egypt repaid $30 billion in foreign currency debt in 2017, according to MENA. The CBE said it had closed 2017 by paying back over $2 billion in debt to AfreximBank and other international creditors.

Al-Masry expected the country’s foreign reserves not to go below the $35 billion safety benchmark in 2018, or enough to cover six months of imports.

Egypt’s foreign reserves have been rising steadily since it secured a $12 billion loan from the IMF in late 2016. The reserves were only $19.041 billion at the end of October 2016, just before the country floated its currency and finalised the loan deal with the IMF.

Egypt is to receive a fourth disbursal of that loan, worth $2 billion, in June or July this year, the Finance Ministry said, bringing the total it has received to $8 billion. The IMF agreed in December to the third disbursal, also worth $2 billion.

*This article was first published in Al-Ahram Weekly

Short link: