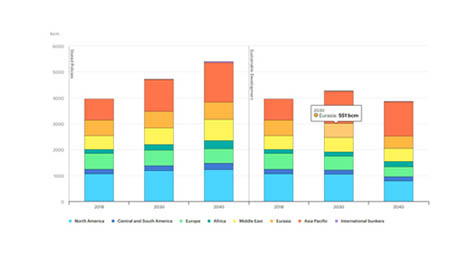

Gas demand by region and scenario 2018

source: IEA

Several factors have combined to create a bleak picture for global oil and gas producers. Crude oil and gas prices are set to decrease in the short and medium term, due to an expected economic slowdown precipitated by the spread of the new coronavirus that started in China in late December and was announced by Chinese authorities in January.

On 12 February, the Organisation of Petroleum Exporting Countries (OPEC) lowered its forecast for oil demand for 2020, citing the spread of the disease as a major factor. Global demand for oil is thus expected to see its first quarterly contraction in over a decade, according to the International Energy Agency (IEA), as the widespread shutdown of China’s economy hits demand for crude.

In February, energy prices dipped to their lowest level since March 2016. Brent crude oil was priced at $54.17 a barrel on 11 February, after prices were as high as $71 a barrel in 2018. Natural gas prices similarly contracted in the first two weeks of February but show signs of longer-term resilience.

The price of natural gas dipped to its lowest level, also since 2016, reaching $1.766 per million British thermal units (BTU). Prices were almost $5 per million BTU in the second half of 2018. The three major markets for natural gas are the US, China, and the Middle East.

In China alone, where industrial and economic activity has substantially slowed down, predictions are that consumption in the month of February will decline by 25 per cent, compared to the same period last year.

On 11 February, the IEA consequently trimmed its short-term natural gas price forecast to $2.21 BTU. The prediction, issued in the agency’s Short-Term Energy Outlook (STEO), cited the additional factor of milder weather as having adversely affected global natural gas demand and resulted in “below-average inventory withdrawals and put downward pressure on natural gas prices”.

China’s falling demand for natural gas will constitute a three per cent drop in global natural gas consumption alone. Short-term Henry Hub natural gas spot prices will average $2.33 per million British thermal units (MMBtu) in 2020 and $2.54 MMBtu in 2021.The Henry Hub pipeline is the pricing point for natural gas futures on the New York Mercantile Exchange.

The fall in natural gas prices, which had already set in at the beginning of 2020, is negatively impacting prices for Egypt’s gas, and the country will likely now change its gas-selling strategy, according to statements made by Petroleum Minister Tarek Al-Molla at the Davos Conference held in January.

The government aims to reduce the amount of liquefied natural gas (LNG) sold via short-term contracts and replace them with renewable 12 to 18-month contracts, aiming to sell the gas at $5 MMBtu.

Al-Molla said that this price was what was needed to cover production costs and admitted that the current plunge in natural gas prices would pose a challenge to the government in this regard.

But the picture is not totally negative for natural gas producers in the longer term. This is because the downward trend in prices comes on the back of a global surge in production over the past decade. The downward trend could change with increased consumption going forward.

The IEA predicts that global consumption of natural gas will more than double over the next three decades, surpassing coal as the world’s number two energy source and potentially overtaking oil in many large industrialised economies.

Natural gas currently accounts for more than half of the world’s demand for energy. It is becoming the fuel of choice, given that it is the cleanest burning fossil fuel. Because of its ecological friendliness and lower emission levels of greenhouse gases, it is replacing coal in many countries.

The IMF forecasts the Henry Hub price to increase to $2.65 per MMBtu in 2024, while the World Bank gives a more optimistic projection of $3.16 per MMBtu. For the long-term forecast to 2030, the World Bank expects the natural gas price at Henry Hub prices to increase to $4 per MMBtu.

However, the IEA cautions that the future growth of demand for natural gas will likely be “more measured” and will depend on economic expansion in emerging markets, especially Asia and China.

*A version of this article appears in print in the 20 February, 2020 edition of Al-Ahram Weekly under headline: Oil and gas take a dip

Short link: