File Photo: An employee turns a valve at the Nahr Bin Omar natural gas field, north of the southern Iraqi port of Basra. AFP

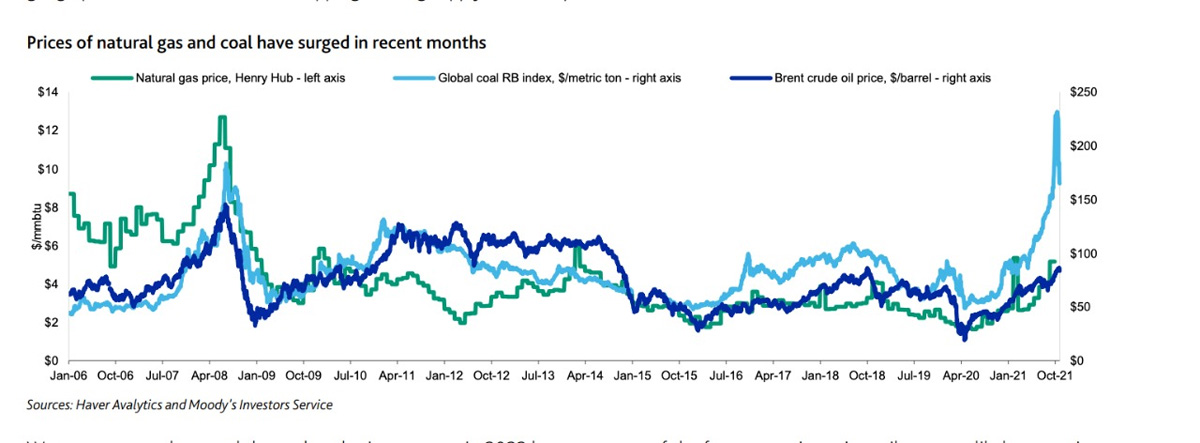

Since August, the global prices of oil, gas, electricity, and coal have significantly increased to their highest levels in decades due to a number of factors; including the rebound of global economic growth after the significant slowdown it had witnessed due to the COVID-19 crisis. This has raised the demand on energy sources, especially oil and fuels in general.

Moreover, the hikes came in the wake of a global transition to clean energy and green economies to serve an international commitment to contain climate change and its associated impacts through 2030.

According to Moody’s, the hikes in global energy prices are the main reason behind the current soaring global inflation rates.

“The simultaneous surge in energy-related commodity prices across geographies is a result of demand outstripping existing supply amid a rapid rebound from shuttered economies. It also reflects a long-term decline of investment in production of all types of fossil-based fuels, which hampers the industry’s capacity to quickly respond to demand surges,” Moody’s explained.

Despite its optimistic expectation, Moody’s stressed that companies will need to reverse the declining investment trend to lower oil and natural gas prices in the medium term.

“A sharp rebound in economic demand pushed all energy prices higher, while varying price volatility revealed differences in market structures, as well as a number of short-lived supply and demand dislocations.”

It also said that although oil prices increased rapidly, the oil market retains some capacity to respond to the swift recovery in demand in 2021 but relies on OPEC+ producers to continue reversing production cuts put in place in 2020 to balance the market amid a sharp fall in demand.

“Outside of OPEC, producers continue to prioritise returns and strengthen balance-sheets over production growth. As the OPEC+ group reverses prior production cuts, it is reducing its spare production capacity and its ability to ease prices in 2022, possibly risking further oil price increases amid increasing demand,” Moody’s elaborated.

“The rise in oil production in 2022 outside of the OPEC+ countries would need to quicken for the market to rebalance without creating further oil price increases.”

The International Monetary Fund also expected global energy prices to ease by 2022 when heating demand wanes and supplies recover.

However, the IMF warned that if energy prices stay high, global growth could be crippled.

Responding to the rise in natural gas prices, Egypt announced on Sunday that it is considering subjecting natural gas to an automatic pricing system that sets the prices according to supply and demand, which is the same system Egypt adopts for fuel pricing.

Short link: