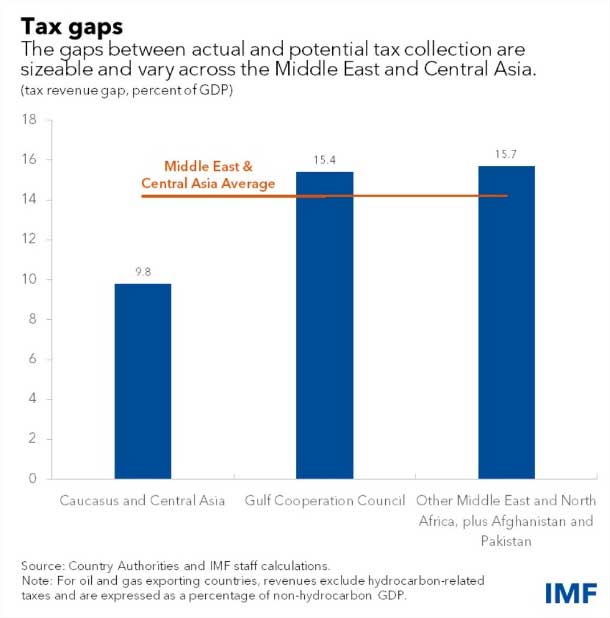

The tax revenue gap, the difference between potential and actual tax collection, is estimated at 14 percent of non-hydrocarbon GDP of the Middle East and Central Asia region, the report said

The report, titled “Revenue Mobilisation for a Resilient and Inclusive Recovery in the Middle East and Central Asia: Executive Summary,” concluded that this large gap needs to be addressed through raising additional tax revenues if the financial issues in the region driven by the ongoing global economic crisis are to be addressed.

In this regard, the report highlighted Egypt’s reforms that aim to reduce informality and promote economic diversification as a way of mobilising revenue.

This include the measures Egypt has taken to lessen the use of cash and to increase financial inclusion.

“The COVID-19 pandemic and the war in Ukraine have compounded challenges to sustainable public finances, underscoring the need for revenue mobilisation efforts. Significant revenue losses during the pandemic, including from measures to ease the tax burden for businesses and households, as well as spending measures to support growth, have weakened public finances and made domestic revenue mobilisation an urgent policy priority for the region. Rising commodity prices because of the war in Ukraine and the policy responses have added to fiscal pressures. Policymakers are looking to limit fiscal risks and scarring effects from the pandemic by adapting the design and pace of tax revenue mobilisation,” the report explained.

These crises have also exacerbated the already-existing societal inequalities and highlighted the importance of raising revenues in an efficient and equitable way, said the report.

“Rising food and fuel prices resulting from the war in Ukraine have hit vulnerable households the hardest. Increasing the efficiency and equity of revenue collection is therefore crucial to help mitigate the negative distributional effects of the pandemic and higher commodity prices. A more efficient tax system would help boost revenue and fund social and infrastructure spending, which can spur growth and reduce inequality of opportunities. Higher and more inclusive growth can strengthen social cohesion and increase tax collection, thus creating a virtuous circle. A more equitable tax system can, in turn, reduce disparities in income and wealth by redistributing income from the top to the bottom of the income distribution,” the report offered.

It asserted that the challenge for the region amid the ongoing crisis is to find the right balance between efficiency and equity in mobilising revenues.

In this respect, the report set number of policies that can enable the region to mobilise tax revenues to provide resources for its spending.

These policies include improving tax policy design to broaden the tax base and increase progressivity and redistributive capacity, strengthening revenue administration to improve compliance, implementing structural reforms to incentivise tax compliance, formalisation, and economic diversification.

Egypt aims for EGP 1.5 trillion in revenues with expected expenses projected at EGP 2.7 trillion during the current FY2022/2023 that rolled out as of 1 July, according to the fiscal year budget plan

Short link: