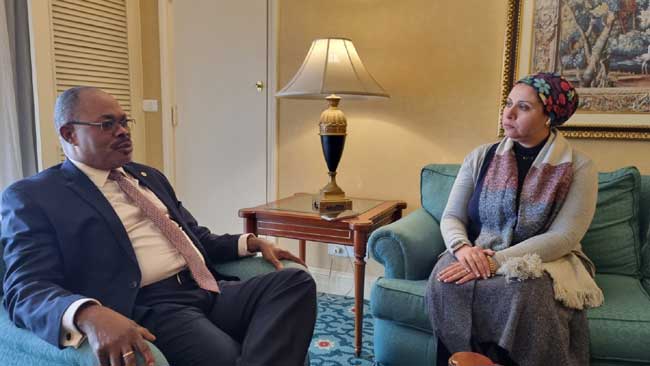

Ahram Online interviewed Nmehielle during his visit to Egypt last week as the head of AfDB’s 58th annual meetings preparatory mission.

This year’s meetings are slated to be hosted by Egypt in Sharm El-Sheikh on 22-26 May.

“Egypt is one of the largest countries that has benefitted from private sector related loans the bank extends”, he added.

As of 27 April 2022, AfDB’s active commitments in Egypt amount to $834.9 million, comprising 24 operations.

This includes 17 sovereign operations, accounting for nearly 73 percent of the active commitments, while the remaining seven operations are non-sovereign operations accounting for about 27 percent.

The portfolio covers sovereign and non-sovereign power (54.5 percent), water and sanitation (23.6 percent), transport (13.7 percent), agriculture and irrigation (4.9 percent), finance (1.9 percent), social protection (0.5 percent) and multi-sector (capacity-building grants) (0.9 percent).

AfDB’s annual meetings bring together finance ministers from the bank group’s eighty-one regional and non-regional member countries, and it is attended by central bank governors, key private sector leaders, academics and development partners to discuss the most recent challenges the continent is facing and explore the best solutions to deal with.

Up to 4,000 participants are expected to attend the 2023 annual meetings that are set to be held at the Sharm El Sheikh International Conference Centre.

“We have no doubt that 2023’s annual meetings will be a successful round based on the significant progress made during the preparation process. I am happy with the speed with which the beautification works of the city of Sharm El-Sheikh have been accomplished since the bank group’s first preparatory mission in September 2022,” Nmehielle told Ahram Online.

During the interview, Nmehielle said that the AfDB’s country strategy for Egypt, which extends through 2026, mainly aims at strengthening Egypt’s competitiveness to support a robust private sector as a key engine of the country’s economic growth, besides building resilience to achieve food and water security and energy efficiency.

Under Egypt’s State Ownership Policy document, Prime Minister Mostafa Madbouly revealed last week the list of 32 state-owned companies that represent investment opportunities for the private sector, either through establishing partnerships with government or through offering minor stakes in the Egyptian Exchange.

The document came into effect earlier in February.

The document lays out Egypt’s plan to raise the private sector share in the national economic activity to 65 percent, up from the current 30 percent, over the coming three years.

Moreover, Egypt has pledged to the International Monetary Fund (IMF), under the new $3 billion loan deal, to boost the role of the private sector in growth in parallel with reducing the size of the state’s footprint in the economy, levelling the playing field between public and private institutions, and strengthening governance and the business climate to support export-driven and private sector-led growth.

Through this pledge, Egypt seeks to close the financing gap estimated at $17 billion over the programme’s four years.

“The harsh economic challenges the continent, including Egypt, is facing due to several factors starting with climate change threats, down to the COVID-19 pandemic’s existing implications and recently the Russian war on Ukraine will be on the meetings’ discussions table in May. The bank group and the stakeholders will also explore how they can engage in order to address these challenges in the member states. This round will focus chiefly on the role the private sector can play amid the ongoing challenging time and also its role in climate financing. Mobilising private sector financing for climate and green growth in Africa is one of the key themes that will be touched upon during the anticipated meetings. Loans cannot do that alone,” Nmehielle explained.

According to the AfDB, Egypt is highly vulnerable to climate change due to its mostly arid climate. In addition, most climate projections point to a worsening of this vulnerability during this century due to a forecast increase in climate risks and impacts, such as extreme weather (heat, floods), lower average yearly rainfall, and increased sea level and salt water intrusion, including in parts of the Nile Delta, which is the breadbasket of the country.

The most sensitive sectors in terms of climate change are health, water and agriculture, and that is where adaptation and mitigation efforts should concentrate, according to the bank.

During the interview, Nmehielle stressed that the upcoming meetings are a significant chance for Egypt to showcase the investments opportunities that could be tapped by the private sector representatives and investors who are planning to attend.

He also added that the event is a platform for Egypt, as well as other African countries, to demonstrate the challenges they are facing in a bid to figure out the most appropriate solutions and avenues to cope with them.

Since the onset of the war in Ukraine in March, about $25 billion of indirect investments have fled the local market; the financing gap has increased to $17 billion; the Egyptian pound has lost over 100 percent of its value and the country’s economic growth is expected to recede to three percent, down from over six percent, by end of the current FY2022/2023.

Ahram Online also discussed with Nmehielle the role the AfDB will play in bridging the financing gap over the upcoming four years.

According to the IMF, Egypt pledged to secure $300 million from the AfDB out of the total financing gap.

In this respect, Vincent affirmed the AfDB’s support to the Egyptian economy, yet, he said that bank has not received any requests from Egypt in this regard.

“Once the government files its request, the matter will be submitted to the bank’s board of directors to make up its decision,” he explained.

Short link: