This is an alarming development for Egypt, which depends on remittances for 7.8 percent of its GDP, according to 2021 figures by the World Bank Group.

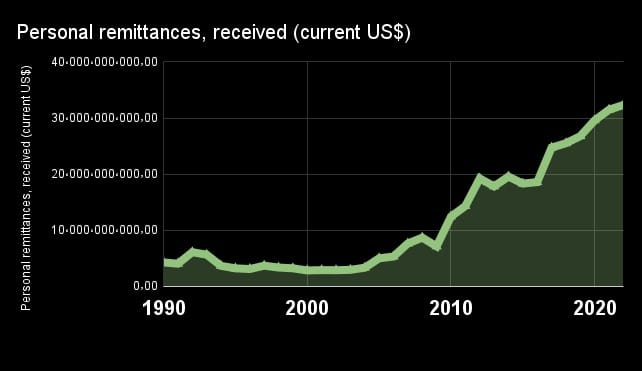

*Data by the World Bank showing the development of remittances in Egypt since the early 1990s.

Remittances are Egypt's main source of foreign currency, surpassing even the Suez Canal and tourism revenues. During the same period, the Suez Canal generated $4 billion while tourism brought in $7.3 billion.

The plunge in remittances is ascribed by experts and expats alike to several factors, including diminished confidence in the economy and the fluctuations in exchange rates.

Fluctuation in exchange rates

According to Khaled Abushadi, an economic analyst, the existence of dual exchange rates is among the key culprits behind the decline.

"As long as there are two exchange rates in the country there will be no stability in the market and there will be no trust as well. The situation requires not just devaluation, but a real flotation of the currency," Abushadi told Ahram Online.

Since March 2022, the Egyptian pound has lost almost 50 percent of its value. The official exchange stands at EGP 31 against the US dollar, but trades at EGP 37 on the black market.

The two exchange rates incentivizes many to hoard dollars, aggravating the existing shortage in the Egyptian market. According to the CBE, Egypt's net foreign assets (NFAs) deficit reached $24.42 billion in March 2023.

NFAs are the sum of foreign assets, including foreign currency, held by monetary authorities and deposit money banks, less their foreign liabilities.

"Most of people here prefer to send their money to Egypt through a colleague who is spending his annual vacation in the country to avoid losing money due to the difference between the official exchange rates and the black market," said Mohammed, an Egyptian expat in Saudi Arabia.

A flexible exchange rate is among the key requirements of the International Monetary Fund (IMF), which is currently reviewing Egypt's economic situation to disburse the second tranche of a $3 billion loan approved in December 2022.

Adopting a flexible exchange rate regime is key to attracting more investors, ensuring hard currency liquidity and raising confidence in the economy, Jihad Azour, the director of the Middle East and Central Asia department at the fund, stated earlier in May.

Alarming data

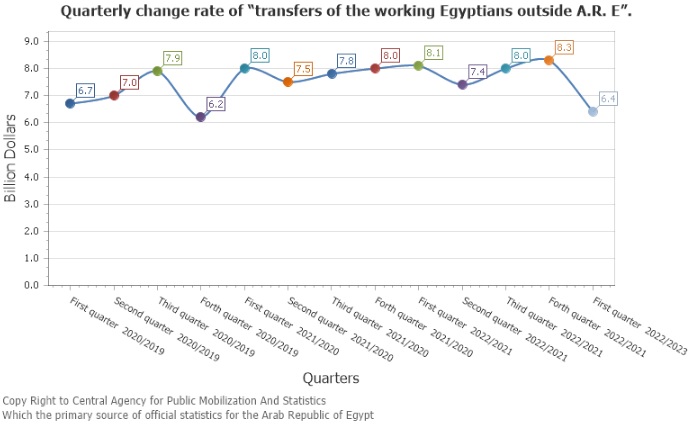

In the first quarter of the fiscal year, remittances reached $6.4 billion, which was the lowest level since the fourth quarter of 2019/2020 in the midst of the pandemic, according to the Central Agency for Public Mobilization and Statistics (CAPMAS).

Data from CAPMAS showed that Egyptian expats’ remittances from Arab countries declined to $21.5 billion in the fiscal year 2021/2022, down 1.8 percent from the year before.

Nader, an Egyptian expat in the UAE, said, "I was discouraged from opening a US dollar account, as my wife in Egypt could not easily withdraw the amount in foreign currency."

"Other colleagues of mine use the services of some exchange companies, but due to the shortage in dollars in Egypt, their families receive the amount in pounds," he added.

Regaining confidence

Investors' confidence in the economy, Abushadi said, is "the key factor impacting remittances, and the economy overall."

"A good example of a lack of confidence is the duty-free car import initiative which has not met even half of its target," the analyst continued.

Based on figures released by the Egyptian Ministry of Finance, Egypt’s initiative enabling citizens outside the country to import cars free of customs duties and taxes has brought in almost $900 million in transfers, or nearly 40 percent of its original target, from its launch in October 2022 until it expired on 14 May.

Meanwhile, banking expert Hany AboulFotouh stressed that "the government should be transparent in its reports and should release economic data in a timely manner" to increase confidence in the economy.

Sustainably growing remittances

To ensure sustainable growth of remittances, the government should "invest in human resources in Egypt to improve the quality and average wage of the Egyptian labour force. That would help the economy and achieve sustainable growth in the value of remittances sent by Egyptian expatriates," Abushadi added.

"The government can also issue sukuk or bonds targeting expats at reasonable rates," he said.

The number of Egyptians living abroad has reached 12 million, according to the Ministry of State for Immigration and Egyptian Expatriates.

Foreign currency shortage

"While Egypt is suffering from the toughest foreign currency crisis in its history, the government has not taken any real decision to address the reasons behind the decline in remittances," AboulFotouh commented.

To compensate, AboulFotouh believes that "the government should move at a faster pace in the implementation of its privatization programme to secure more foreign currency."

In February 2023, the Egyptian government announced plans to offer 32 state-owned companies operating in 18 sectors to strategic investors within a year.

The CEO of NI Capital, the Egyptian government financial adviser revealed that Egypt is preparing two state-owned companies to be offered as investments before the end of the current fiscal year.

The government offered a 10 percent stake in Telecom Egypt in two tranches totalling 170.7 million shares, although it was not on the list of the 32 companies.

Egypt's Minister of Planning and Economic Development, Hala El-Said, announced Tuesday in the Senate that the government aims to collect $83 billion in foreign currencies during FY 2023/24 through four streams.

Around $31 billion of the target is projected to come from remittances sent by Egyptian expatriates.

Short link: