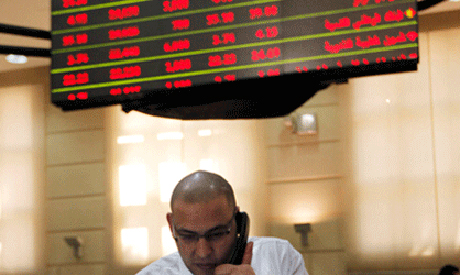

Back in red: Egypt's exchange takes first dip since last week (Photo: AP)

Egypt stocks dipped back into the red on Thursday as resurgent local investors indulged in a wave of profit-taking in the final hours of the trading week.

The benchmark EGX30 slipped 0.91 per cent to close at 3,868 points, pummelled by across-the-board losses. Between Sunday and Wednesday, the main index managed to rally a total of 3.4 per cent, reflecting flickers of optimism over Egypt's economic recovery.

"It's profit-taking after several days in the green -- this is the kind of thing we expect at the end of a week," Issa Fathy, vice president of the securities division at Cairo's Chamber of Commerce, told Ahram Online.

Just over a dozen stocks saw gains in trade worth around LE242.4 million (US$40.1m), with mass sell-offs of lower-cap shares slashing the broader EGX70 index by 2.1 per cent.

Foreign investors went against the tide to become Thursday's sole net-buyers, scooping up LE19.4 million in stocks.

"This is what we call smart money," explained Fathy. "With a crisis threatening European stocks foreigners are preferring to inject money in emerging markets like Egypt as long as they are stable."

Egypt's largest listed company, Orascom Construction Industries (OCI) was the only heavy-duty stock to survive the day's cull, climbing 0.6 per cent and cushioning the main index from greater loss.

"Over the last few weeks OCI has had a package of agreements and contracts but general market sentiment masked the effects. Now we are seeing the impact," said Fathy.

Investment bank Beltone Financial slumped 2.7 per cent following the news its chairman had agreed to sell his 20 per cent stake in the firm an Arab investment company.

Commercial International Bank (CIB), long a weathervane of foreign involvement in the Bourse, also lost 1.38 per cent, in a sign investors are adapting their strategies.

"Foreigners are not trading on [banks like CIB] anymore after their credit rating have been downgraded," said Fathy. Fitch Ratings slashing the ratings of CIB and two other Egyptian national banks in early January.

From the day's 168 listed stocks, 143 lost value and only 15 gained.

Short link: