The logo of the International Monetary Fund is visible on their building, April 5, 2021, AP

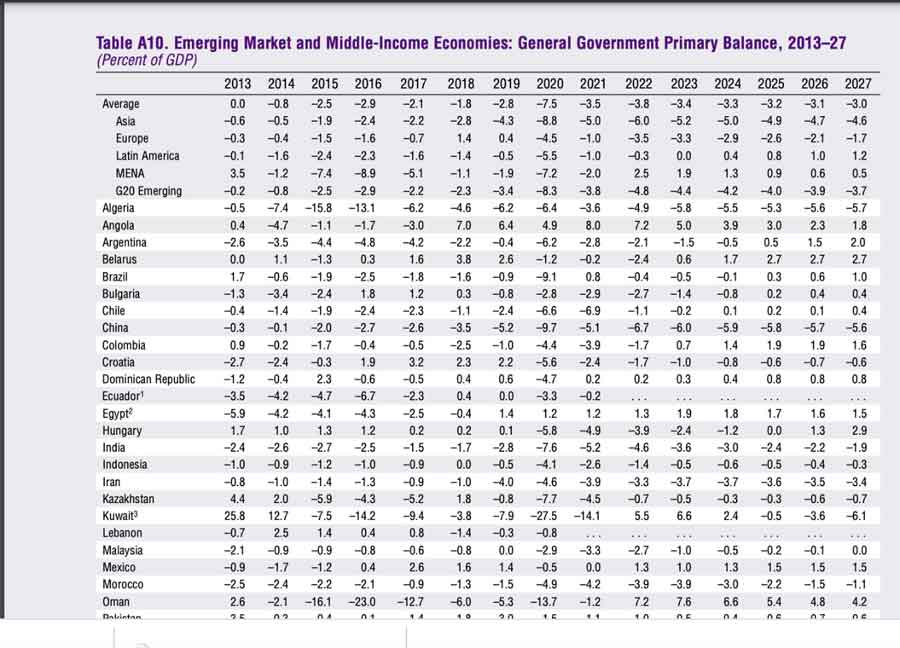

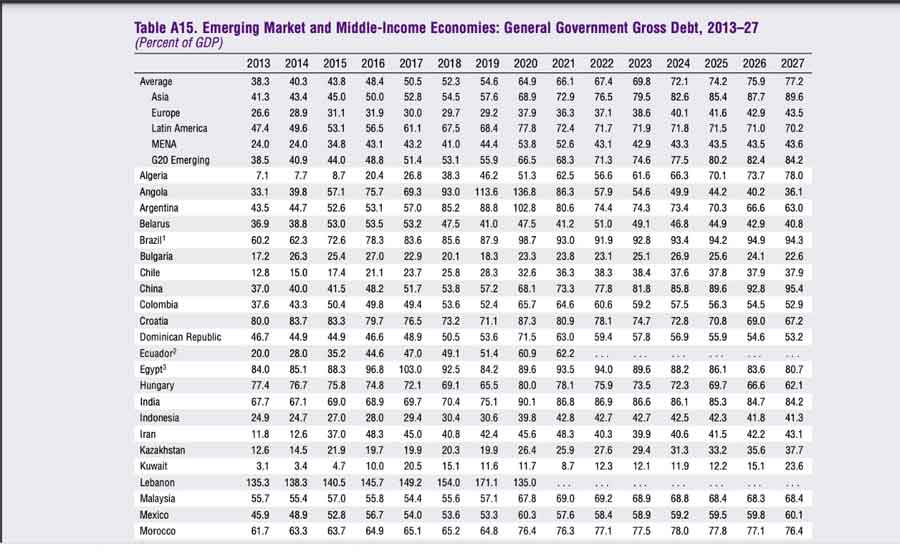

In its Fiscal Monitor Report, the IMF projected the general government’s net debt to GDP ratio to rise to 89.1 percent in 2022, up from 2021’s 88.6 percent, expecting it to continue its downturn through 2027 to reach 75.8 percent.

According to the latest figures published by the Central Bank of Egypt (CBE), the country’s total external debt jumped to EGP 145.5 billion in the second quarter (2Q) of the current FY2021/22 — October to December 2021 — up from the EGP 137.4 billion recorded in 1Q.

The IMF report also expected Egypt’s gross financial needs to record 35.8 percent of the GDP amid the ongoing economic challenges.

According to the report, the Russian-Ukrainian conflict represents an urgent challenge for governments globally as the risk of and the consequences of imposing economic sanctions on Russia has triggered major disruptions in commodity markets.

“Russia accounts for about 45 percent of the EU’s total gas imports and 10 percent of global oil exports. In food markets, Russia and Ukraine account for one quarter of global wheat, one-seventh of corn, and three-quarters of sunflower oils exports,” the report said.

“Since the war started, supply disruptions have steepened the rising trends in energy and food prices. The broad-based food price index of the Food and Agriculture Organisation of the UU reached its all-time high since the index was introduced in 1990. Commodity prices are also more volatile,” it explained.

Moreover, the increase in food prices is expected to amplify amid fertiliser shortages, as Russia and Belarus account for one-fifth of global fertiliser exports, especially potassic fertilizers — representing one-third of global trade — and nitrogenous fertilisers.

In this respect, the report said that fertiliser prices had already risen by about 80 percent over the last 12 months.

Global public debt is also expected to stabilise at around 94 percent of GDP through 2024; well above pre-pandemic levels.

“This level raises concerns about debt vulnerabilities and financial stability and weighing on growth prospects, especially if interest rates rise faster than expected,” said the report.

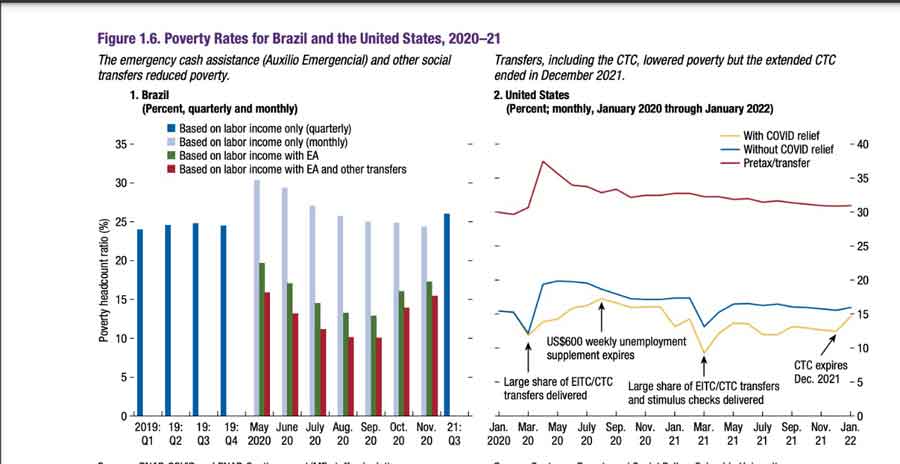

For the global elevating inflation, the report noted that it has important implications for public finances and policies, which rely on how persistent higher inflation is and how monetary policy responds.

“The initial effect of inflation in 2021 was a reduction in debt-to-GDP ratios. Surprise inflation — the difference between actual and projected inflation rates — contributed to an average decline in global debt projections of around 2 percent of GDP relative to 2020, shaving about 1.8 percent off 2021 public debt to GDP ratios in advanced economies and 4.1 percent off in emerging markets excluding China,” the report illustrated.

It added that the Ukrainian war has caused a further unexpected rise in food and energy prices with extra effects on debt ratios.

On the other hand, it said that 2022’s fiscal balance could benefit from higher inflation.

In this regard, the report estimated that a surprise of one percent in the annual inflation rate could increase nominal revenues by 0.8 percent in emerging markets and 0.3 percent in advanced economies, adding that inflation surprises are associated with lower fiscal deficits in the short term, though spending pressures are likely to rise over time.

However, the rise in inflation is likely to be followed by increasing interest rates and higher debt burdens.

Short link: