File Photo: A factory employee works in a thread spinning factory in Cairo, Egypt, July 5, 2018. REUTERS

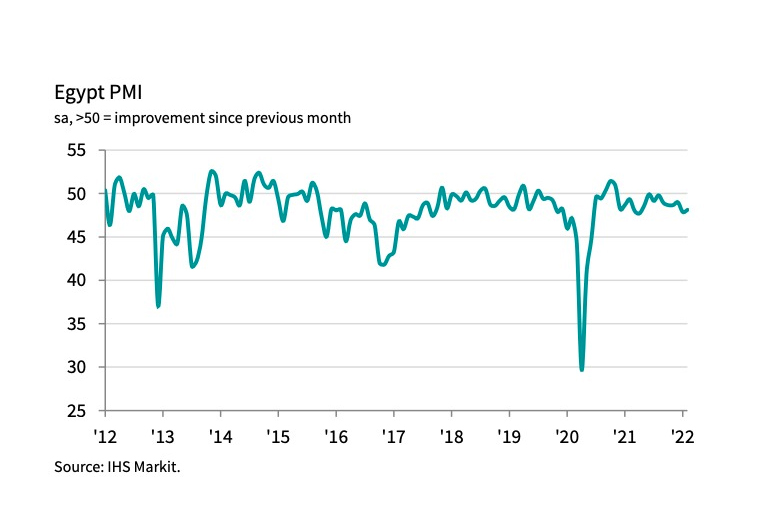

However, February’s reading is still below the 50 neutral mark for the 15th consecutive month.

Within Egypt’s private sector, output and new orders sub-indices for the non-oil businesses witnessed a significant contraction during February with a strong decline in activity as a result of weaker sales, according to the report.

It also added that recent price hikes likely contributed to a drop in client demand during February.

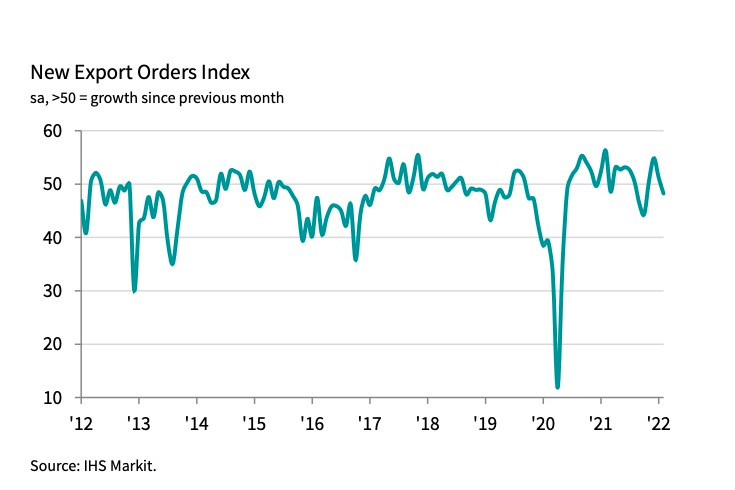

“New orders from abroad decreased for the first time since October 2021. Of the four main sectors covered by the report, the strongest downturns in output and new business were seen in construction. By contrast, manufacturing was the only area to see an outright (but marginal) expansion in new orders over the latest report period,” the report explained.

The report said non-oil companies expect a waning outlook for the sector activity going ahead, according to its survey conducted in February.

“Concerns about economic conditions and the impact of high prices meant that the level of confidence dropped to its lowest level since this series began in April 2012. Only 11 percent of businesses expect output to expand over the next 12 months.”

Consequently, the companies reduced their staffing levels, resulting in a fourth successive monthly drop in employment in the sector.

In terms of purchasing activity within the sector, the report showed that it also contracted in February, marking the third decrease over the past four months.

“However, companies found that this led to only a slight decrease in total inventories. Supply chain performance meanwhile deteriorated as some firms experienced temporary disruption as they searched for cheaper delivery options,” according to the report.

On the upside, the report mentioned that the inflation rate of input prices witnessed a slowdown during February, following a surge in material prices in recent months due to the pandemic and its associated impacts.

“Purchase prices continued to rise sharply, though the pace weakened to the slowest since last July, while there was a second successive fall in salary costs”, the report explained.

As a result, non-oil private sector companies raised their output charges at a marginal pace through the first quarter of 2011.

"The pandemic-led surge in input prices and the Omicron wave continued to derail Egypt's recovery in the first quarter of 2022, as the February PMI signalled a deterioration in non-oil economic conditions. Output, new business, employment and purchases were all down, with output falling at a fractionally softer pace than January's 19-month record”, said David Owen, Economist at IHS Markit.

He added that businesses across the sector continued to express concerns that the pandemic would constrain activity over 2022.

Additionally, companies’ confidence fell to its lowest level in the report series history, with just 11 percent of companies reporting a positive outlook for the upcoming year, according to Owen.

He also expounded that weaker price pressures are expected, as the latest data indicated a marked softening of input cost inflation since the start of 2022.

Egypt’s governmental Central Agency for Public Mobilisation and Statistics (CAPMAS) is anticipated to announce the country’s inflation readings for February next week.

Short link: