Towards curbing inflation

The Central Bank of Egypt’s (CBE) Monetary Policy Committee (MPC) defied expectations on 22 September when it maintained key interest rates at 11.25 per cent for overnight deposits and 12.25 per cent for lending.

There had earlier been forecasts that the MPC would raise interest rates in an attempt to put the brakes on surging inflation. However, the CBE did increase its reserve requirement for all banks to 18 per cent from the current 14 per cent.

Raising the reserve ratio — the money that banks must put aside and not invest — is an effective tool for monetary tightening that helps to withdraw excess liquidity or reduce the money supply, said Radwa Al-Sweify, head of research at Pharos Holding.

Raising the ratio is a faster and more effective tool in tightening financial conditions, and it does not have the same negative repercussions on the economy as increasing interest rates, she said. The effects of raising interest rates can take six months to be visible in the market, while it also has negative effects on growth and the budget deficit.

Investors need low interest rates in order to borrow cheaply to expand their businesses, she explained.

The CBE estimates that the excess liquidity in the banking system stands at LE600 billion. The four per cent increase in the required reserve is expected to help withdraw LE140 to LE150 billion of this.

The same method was applied in October 2017 when the CBE raised the required reserve from 10 per cent to 14 per cent.

The MPC decision in maintaining interest rates “is logical in the light of the rising prices of commodities worldwide and the current pressures on the state budget, coupled with the government’s desire to support economic growth,” Al-Sweify said.

The CBE said in a statement that it is committed to attaining lower, stable inflation rates in the medium term, a key requirement to achieving sustainable growth. “The current key rates coupled with the increased required reserve ratio are consistent with achieving price stability over the medium term,” a CBE press release said.

“The elevated annual headline inflation rate will continue to be temporarily tolerated above the CBE’s pre-announced target of seven per cent (± two percentage points) on average in the fourth quarter of 2022,” the CBE said.

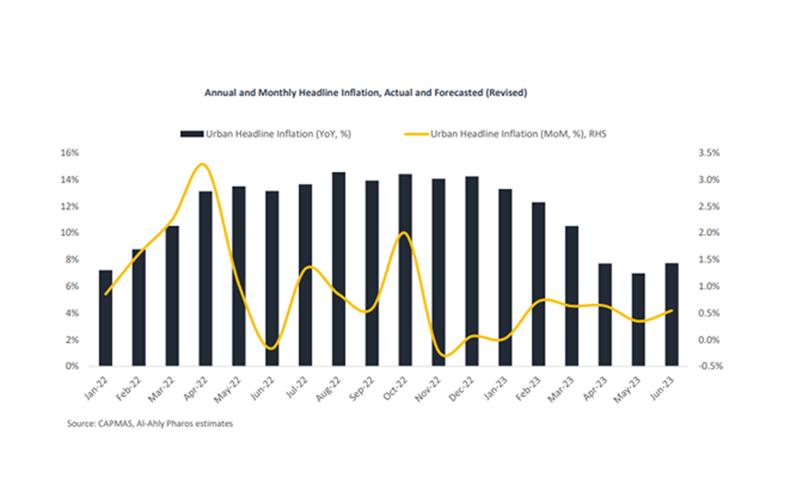

Annual urban inflation rose to 14.6 per cent in August, up from 13.6 per cent in July, reported the CBE. Annual headline inflation also reached 16.7 per cent in August, up from 15.6 per cent in July. The rate is calculated excluding the prices of fresh vegetables and fruit and electricity and energy sources.

Al-Sweify expects inflation to reach its peak in the fourth quarter of 2022 before cooling down in April 2023 and settling in the CBE’s targeted range in the second half of 2023.

Increasing interest rates by one per cent adds LE60 billion to the state budget, economic expert Hani Tawfik was quoted as saying. This is because higher interest rates translate into an increase in the bill the government has to pay investors in government bonds and treasury bills.

They increase the burden of debt-servicing on the government, CEO of Zilla Capital Wael Ziyada said. In the meantime, increasing interest rates will not be useful in attracting back foreign investors to Egypt’s carry trade. Some $20 billion formerly invested in Egypt’s debt market has fled the country since the beginning of the year.

Al-Sweify said the larger reserve requirement means that the banks will not be investing so much of their funds in treasury bills or lending them out, and this will affect profits.

To compensate for the loss of returns, the banks are likely to lower the interest rates they pay on deposits. However, that option may be difficult to implement due to the ongoing competition between the public and private-sector banks for depositors.

In the fourth quarter of 2017, when the CBE again raised the required reserve ratio, the banks slightly lowered the interest rates they pay on deposits. As a result, they saw less profitability for the fourth quarter of 2017 and the first quarter of 2018, Al-Sweify noted.

*A version of this article appears in print in the 29 September, 2022 edition of Al-Ahram Weekly.

Short link: